In the 21st century, technology has not only become a pivotal part of our daily lives but a critical tool in managing finances and fostering economic growth. From the simple conveniences offered by smartphone apps to the complex algorithms managing stock portfolios, technology is an omnipresent force reshaping the way we think about and handle our money. This article will delve into the myriad ways smart tech investments can lead to significant savings, ultimately enhancing our financial well-being.

The Rise of Fintech: Revolutionizing Personal Finance

Financial technology, or fintech, has been a game-changer in the personal finance sector. With the advent of mobile banking, budgeting apps, and digital investment platforms, consumers now have unprecedented control over their financial lives. These tools offer a level of convenience and accessibility that traditional banking and financial services struggled to provide.

For instance, budgeting apps have simplified the tracking of expenses and income, making it easier for individuals to stick to a budget and save money. They can categorize transactions automatically, provide a real-time overview of spending, and even offer personalized tips for saving money based on spending patterns.

Investment apps, on the other hand, have democratized the investment landscape, allowing users with minimal experience to start investing with small amounts of money. Features like robo-advisors utilize algorithms to manage portfolios, reducing the need for expensive financial advisors and making investment advice more accessible and affordable for the average person.

Energy Efficiency: Reducing Bills and Carbon Footprints

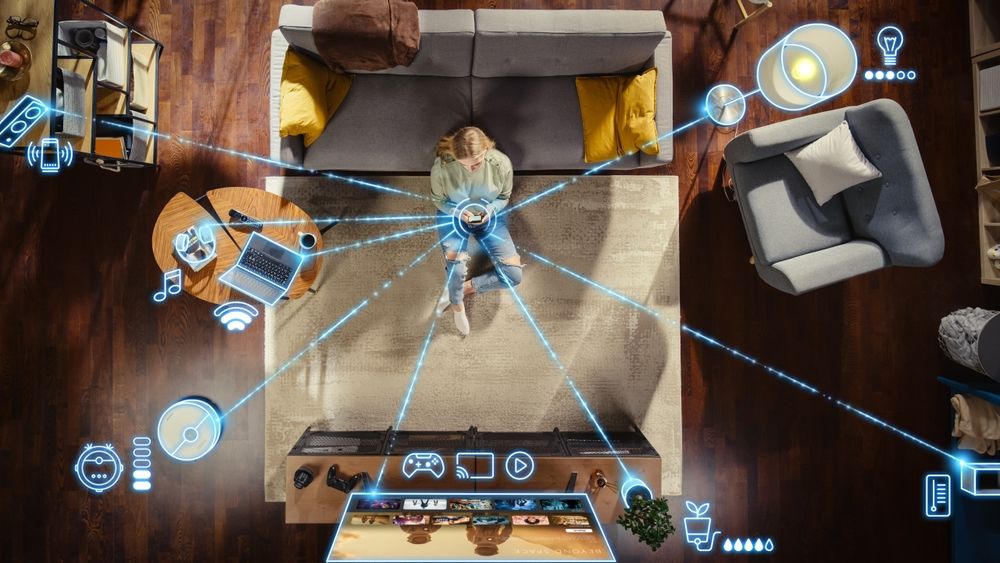

Smart technology investments often lead to energy efficiency, which is not only good for the planet but also for your wallet. Smart home devices such as thermostats, lighting, and energy monitors can drastically reduce utility bills. Smart thermostats learn your schedule and adjust heating and cooling accordingly to ensure that you’re not wasting energy when you’re not home. Similarly, smart lights can be programmed to turn off automatically when no one is in the room, and energy monitors provide insight into which devices are consuming the most power.

These technologies not only help you save money by reducing your monthly bills but also contribute to a larger global effort to reduce energy consumption and greenhouse gas emissions. As utility companies increasingly offer incentives and rebates for energy-efficient appliances and devices, the initial cost of these smart tech investments is offset by long-term savings and potential tax benefits.

Automating Savings and Investments

Automation has made saving money easier and more effective than ever before. By setting up automatic transfers to savings accounts or investment funds, you can ensure that you’re consistently setting aside money without having to think about it. This “set it and forget it” approach eliminates the temptation to spend what you might otherwise save and harnesses the power of compound interest over time.

Moreover, the rise of micro-investing platforms allows users to invest spare change by rounding up transactions to the nearest dollar. This seemingly small act can build up a considerable investment over time without any significant impact on the user’s lifestyle. The automation of these small investments, combined with the elimination of traditional transaction fees, makes investing more accessible and less intimidating.

Cybersecurity: Protecting Your Financial Health

As we increasingly rely on technology for our financial transactions, cybersecurity has become a paramount concern. Investing in robust cybersecurity measures can save individuals and businesses a great deal of money by preventing data breaches, identity theft, and fraudulent transactions.

Personal cybersecurity measures, such as using secure passwords, enabling two-factor authentication, and investing in reputable antivirus software, can protect your financial information from being compromised. For businesses, the stakes are even higher, as data breaches can lead to significant financial losses, legal liabilities, and damage to the company’s reputation.

In addition, being aware of the latest cybersecurity threats and understanding how to protect oneself against them is an investment in one’s financial health that cannot be overstated. Education and vigilance are key components of a smart tech investment strategy in the digital age.

Tech-Savvy Shopping: Get More for Less

Finally, technology has transformed the way we shop and spend money. From price comparison websites to coupon and cashback apps, there are countless tools at our disposal to ensure we’re getting the best deals. These technologies not only save us money on purchases but also save time by streamlining the shopping process.

Price comparison websites allow consumers to quickly find the retailer offering the lowest price for a particular product, while coupon apps aggregate discounts and promo codes from various sources. Cashback apps and browser extensions reward shoppers with a percentage of their purchase back, effectively making every sale that much sweeter.

Moreover, subscription management services help users keep track of recurring expenses and identify those that are unnecessary or can be reduced. By leveraging these tools, consumers can make more informed decisions, avoid overspending, and maximize their purchasing power.

In sum, technology has infiltrated nearly every aspect of financial management, from saving and investing to shopping and energy consumption. The smart tech investments discussed here represent just a fraction of the tools and strategies available to individuals and businesses looking to save money and bolster their financial health.

By embracing fintech for personal finance, investing in energy-efficient technologies, automating savings, prioritizing cybersecurity, and shopping smarter with tech tools, we can all harness the power of technology to achieve greater financial prosperity. As technology continues to evolve, staying informed and adaptable will be key to maximizing its potential for economic benefit. Whether you’re a tech-savvy millennial or a beginner looking to streamline your finances, the time to invest in smart technology is now.