In today’s interconnected world, banking has transcended beyond the physical borders of countries, offering individuals and businesses the possibility to manage their finances across the globe. Offshore accounts, once the exclusive domain of the ultra-wealthy or the subject of spy movies, have become accessible and practical financial tools for a diverse range of people. In this article, we’ll explore the myriad benefits of offshore banking and how it can be an integral component of savvy financial planning.

What is Offshore Banking?

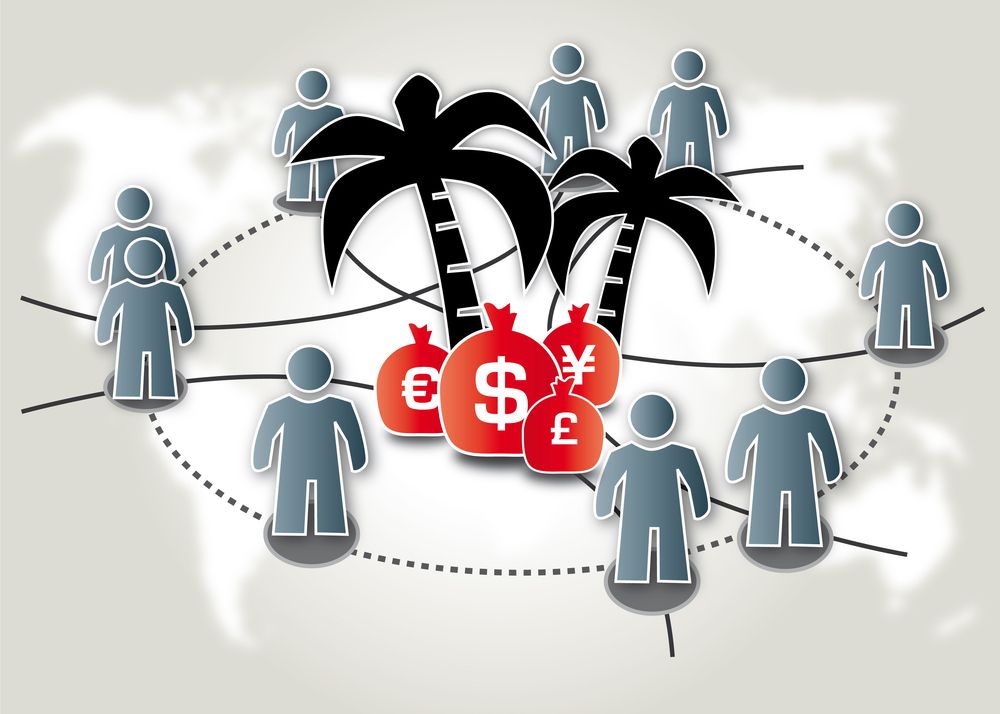

Offshore banking refers to the process of keeping money in a bank account outside one’s country of residence. Often, these accounts are in jurisdictions with favorable banking laws that provide advantages not available domestically. The term ‘offshore’ may evoke images of exotic locales, but in reality, an offshore account can be located in any foreign country.

Privacy and Confidentiality

One of the most touted benefits of offshore banking is the level of privacy and confidentiality afforded to account holders. Many offshore jurisdictions have strict laws in place to protect the identity of account holders and their transactions. This is not to suggest that offshore banking is a way to evade legal responsibilities or to engage in illicit activities; rather, it provides a lawful means to manage one’s finances with a high degree of privacy. Wealthy individuals often use offshore accounts to protect their assets from frivolous lawsuits or to manage their wealth discreetly.

Asset Protection

Asset protection is a key reason why individuals and businesses opt for offshore accounts. These accounts can offer a safeguard against political or economic instability in one’s home country. If you live in a region prone to civil unrest or erratic policy decisions that could jeopardize personal assets, keeping some of your wealth in a more stable jurisdiction can provide a buffer. Additionally, offshore accounts can protect against legal judgments. Although this doesn’t mean that one can avoid legal responsibility, certain offshore jurisdictions make it difficult for creditors to seize assets, providing a layer of protection for account holders against aggressive litigation.

Tax Optimization

While the issue of taxation and offshore accounts can be controversial, it is important to note that there are legitimate ways to use these accounts for tax optimization. Some offshore financial centers offer low or no tax on capital gains, interest, or inheritance, which can be attractive to those looking to manage their tax burden legally and efficiently. It is vital, however, to comply with all tax laws and regulations in your country of residence regarding foreign accounts and income. Tax optimization should not be confused with tax evasion, and it is crucial to seek professional advice to ensure all activities are above board.

Diversification of Currency and Investment

Diversification is a fundamental principle in finance, and offshore banking allows for diversification not only of assets but also of currency. Holding funds in different currencies can be a hedge against currency devaluation in your home country. Offshore banks typically offer a range of investment opportunities that may not be available domestically. This can include access to international markets and investment funds, providing a broader platform for growing your wealth. Diversification can reduce risk and potentially increase returns over the long term.

Convenience for Global Citizens

For expatriates, frequent travelers, or those who conduct business internationally, the convenience offered by offshore banking is unmatched. It enables easy access to funds from anywhere in the world and often comes with a suite of services tailored to the global citizen. Offshore banks are accustomed to dealing with clients who live a transnational lifestyle and can offer services in multiple languages, 24/7 customer support, and online banking platforms that make managing finances from anywhere simple and efficient.

Offshore accounts can serve as a valuable tool in one’s financial arsenal, offering benefits that extend beyond simple tax incentives. From enhancing privacy and asset protection to providing opportunities for currency and investment diversification, offshore banking can facilitate a more robust and flexible approach to wealth management. Moreover, for those living a global lifestyle, the convenience of offshore banking is undeniable.

However, it is critical to navigate offshore banking with a clear understanding of the legal implications and with the guidance of financial and legal experts. Transparency with tax authorities and compliance with all regulations are paramount to ensuring that the benefits of offshore banking are enjoyed responsibly and legally.

As the world becomes increasingly globalized, the relevancy of offshore banking continues to grow. Whether you are an individual seeking to protect your assets, a business owner looking to expand internationally, or a global traveler desiring financial ease, offshore banking may present the solutions you need. By banking beyond borders, you open up a world of possibilities for managing and preserving your wealth in today’s dynamic financial landscape.